In a constantly moving world, global restrictions due to Covid-19 created intense pressure on the aviation industry. Undoubtedly, jet fuel trade amid the pandemic suffered significant losses. With the first half of 2021 already completed, a restrained optimism hovers that the situation is gradually improving. Do the numbers confirm this?

In order to contain the spread of the virus, the imposition of travel bans dramatically reduced flight volumes. Global air transport abruptly shrank and consequently the aviation fuel market has been significantly disrupted.

According to the Energy Information Administration (EIA), commercial flights averaged little more than 70,000 flights per day in January and February 2020. In April they fell to an average of less than 25,000 flights per day. A similar pattern followed for commercial jet fuel consumption, falling from an average of 4.3 million barrels per day in January and February to just 1 million in April.

The Big Drop Off

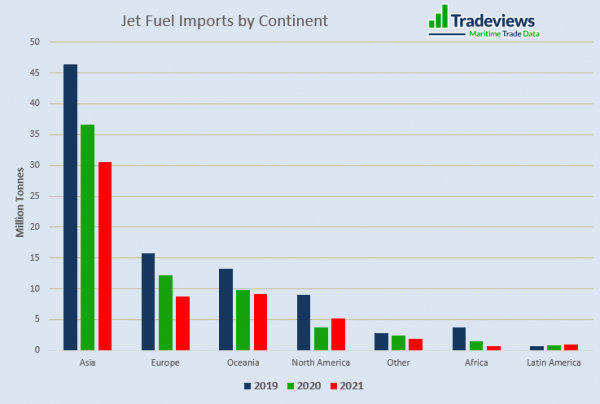

The pandemic had the power to affect more or less every aspect of our lives. Aviation fuel trade in product tankers was particularly affected. Throughout 2020, jet fuel trade decreased from around 92 to 67 million tonnes. During the majority of that year, the downturn was approximately a third, compared to the previous year. Among the countries that limited their imports were China, Australia and of course many European counties, whilst the Philippines and Vietnam experienced significant drops of 70% and 86% respectively.

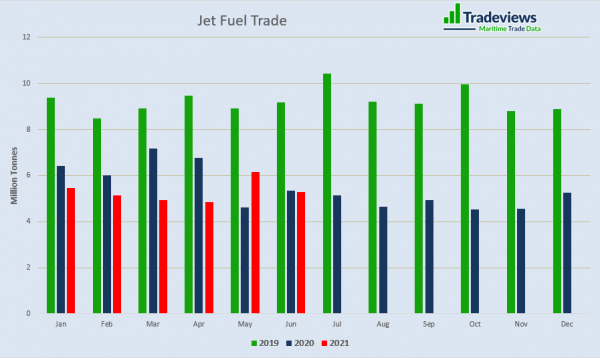

2021 was supposed to give many hope for a gradual recovery to the pre-corona crisis volume and growth rates, amid the vaccination plan. However, another wave of the pandemic has been working its way around the globe. In addition, the appearance of various mutations again disrupted the return to normality. This unstable situation was also reflected in trade. The first half of 2021 is following a downwards trend, with an exception of May, when trade increased from 4.8 to 6.1 million tonnes.

Market Impacts

Asia is the largest influencer of the jet fuel market. European and Australian jet fuel markets have suffered a similar impact from the pandemic to Asia. Our data presented in the graph below indicates China’s market drop. Levels fell by a third, from over 45 million tonnes of jet fuel imports in 2019, to around 30 million during 2021. Whilst the drop in imports is similar in Europe and Oceania (Australia) the sheer volume of Asian imports reflects a large knock-on effect resulting from the pandemic. Our data also reflects that North America (mainly the USA) experienced a significant drop in import demand due to reduced aviation activity, however they managed to bounce back in 2021.

New Perspectives

The impact of Covid-19 on the fuel market could leave lasting consequences. The effect on aviation fuel markets amid the pandemic could spur a move to more sustainable fuel use. Besides the reduction of CO2 emissions in the spotlight, decarbonization talk and action is gathering speed. The truth is that there may be ideal grounds to start a global shift in behaviour. The implementation of CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation) could change the way the industry operates. However, various obstacles are in the way.

Although aviation activity is trying to bounce back, the level of this activity is still significantly below 2019’s. In such a context, it becomes more difficult to invest on sustainable fuels and innovative technologies. Ironically, demand has to be stronger. Whether current sustainable fuels will reduce the emissions remains controversial.

Final Thoughts

A delayed recovery for the aviation fuel market is apparent. May was the best month so far this year, but remains insufficient to chart a steady upward trend. So, the big question is when will the market return – or has the travel industry changed forever? The truth is that 2019 levels set the bar high. Therefore, with the successive measures still taken to deal with the pandemic, a bounce back to those levels is unlikely to happen before 2023.