The debate over the role of domestic steel in the US has turned highly political.

We look at:

- Controversy over Nippon Steel’s bid to purchase US Steel

- Tradeviews Perspective

- The structure of steelmaking in the US

- What steel categories are being imported?

- Where is steel imported from?

- Steel Imports from Mexico becoming a target?

- New worries over an influx of steel from Viet Nam

- Embracing change in the US steel sector

- What next?

Nippon steel’s bid to purchase US steel

Nippon Steel continues to press ahead with its US$14.9 billion bid to acquire US Steel despite President Joe Biden saying that it is vital that the company remains domestically owned and operated. Biden’s presidential opponent Donald Trump has already stated that he would immediately block the purchase if elected. The proposed deal is currently being investigated by the Committee on Foreign Investment in the United States.

According to the World Steel Association, US steel is now the 24th largest steel producer in the world. Fifteen years ago, it was the 10th largest. Might a takeover by the world’s 4th largest producer, Nippon Steel, provide much needed new capital and technical innovation?

Tradeviews Perspective

Tradeviews’ Forecasting Director, Len Hockley, spent several years as an expert witness in a high-profile antitrust lawsuit regarding iron ore shipping on the Great Lakes. This firsthand experience involved in-depth analysis of the inner workings of iconic steel industry names like Republic Steel, Jones and Laughlin Steel, Wheeling-Pittsburgh, and Youngstown Sheet and Tube. The case ultimately saw a railroad subsidiary of US Steel as the final, and unsuccessful, defendant. This experience gave our Director a deep understanding of the complexities and intricacies of the US Steel industry.

Steelmaking in the US has seen insolvency, mergers, buy outs and plant closures. The industry has struggled against low-cost steel imports and comparatively high labour costs. New non-unionised steel mills have also emerged outside traditional northern steelmaking states.

Steel is still politically important in the so-called rustbelt states, including key swing states in the upcoming presidential election. The same is true in congressional and senatorial races.

The Structure of Steelmaking in the US

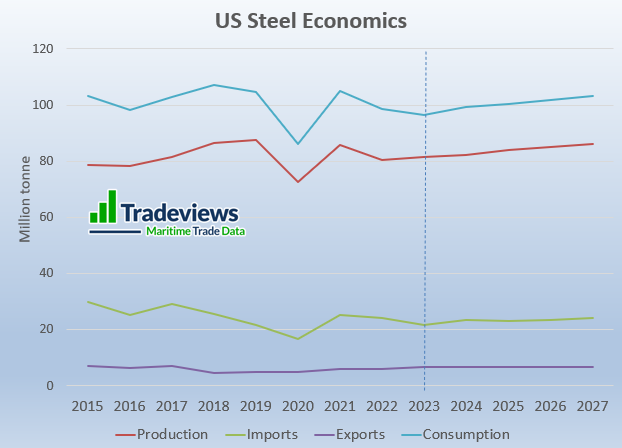

The US is a significant net importer of steel. Indeed, it is the largest steel importing country in the world, albeit less than the European Union block. However, it has produced domestically the equivalent of around 83% of its domestic steel consumption in recent years.

What steel categories are being imported?

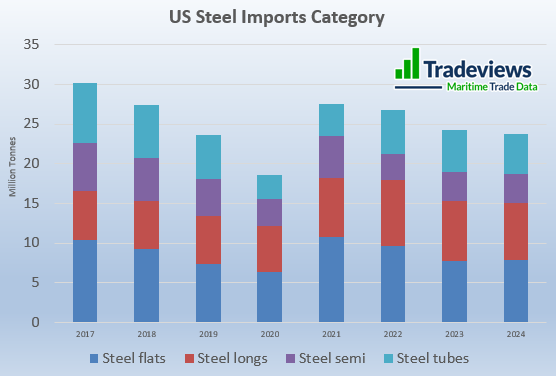

US steel imports cover a wide spectrum when it comes to individual product categories.

Where is steel imported from?

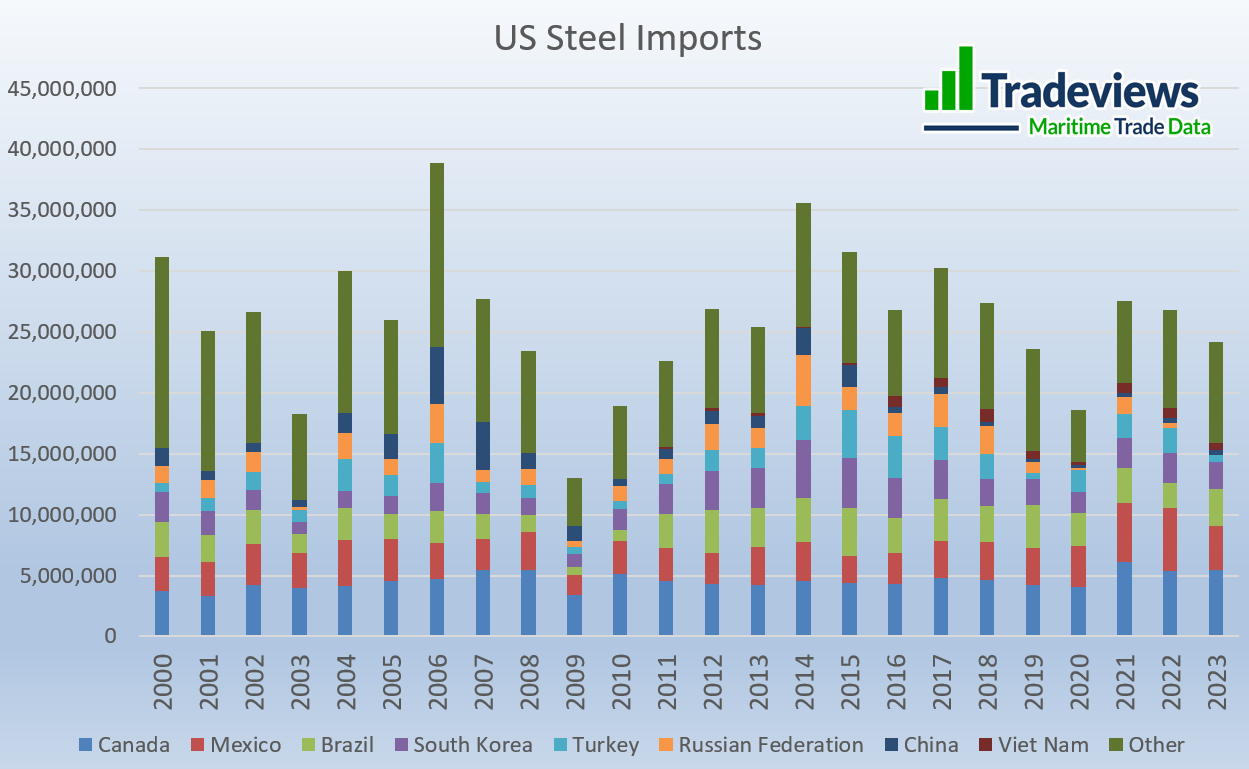

Canada, Mexico, Brazil and South Korea continue to be the main suppliers of steel to the US. China has long been vilified in the US as an overproducer of steel dumping excess production into overseas markets. President Biden proposed raising tariffs on certain Chinese steel and aluminium products from 7.5% to 25% while on the campaign trail in April. However, shipments of Chinese steel into have already largely dried up. US imports of Russian steel have also been halted by sanctions following its invasion of Ukraine. More recently, we have seen new steel suppliers emerge, including Egypt and Algeria.

Steel Imports from Mexico becoming a Target?

The US and Mexico recently announced new steps to fight the circumvention of US tariffs on steel and aluminium by certain countries that ship products through Mexico. Imports of steel products from Mexico will be subject to 25% US Section 232 tariffs unless the steel is documented to have been melted and poured in Mexico, the US or Canada.

In another move, the US Senators Alliance is calling for the restoration of Section 232 stell import tariffs of 25% on Mexico despite its membership of the USMCA free trade agreement between the US, Canada and Mexico. The Senators’ bill is being supported by American Iron and Steel Institute.

New worries over an Influx of Steel from Vietnam

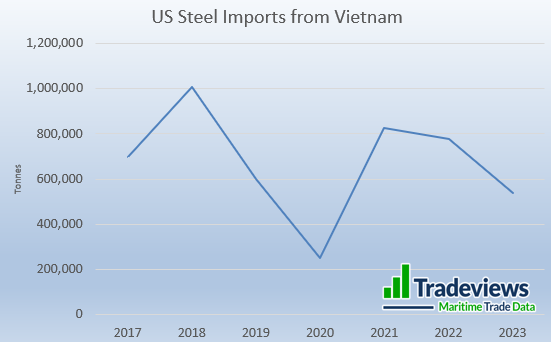

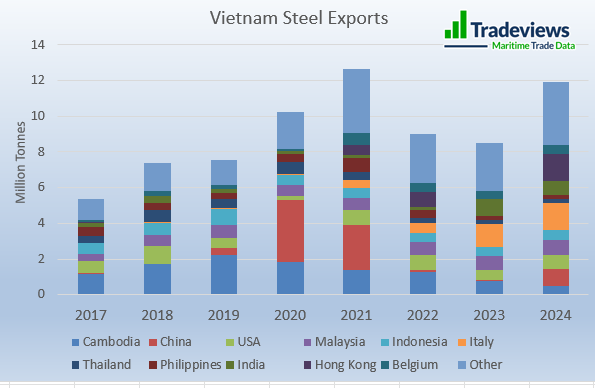

Industry reports have talked of a recent surge in steel imports from Vietnam raising suspicions of dumping practices. Vietnam has been a steady, albeit modest supplier of steel to the US in recent years. A look at monthly trade flows does show a recent pickup but not a dramatic surge. This diversion of trade may in part be down to Viet Nam seeing a sharp reduction in exports shipments to China.

Embracing change in the US steel sector

There have been new developments. US Steel has started to produce direct reduced iron pellets at its Keetac plant in Minnesota. The plant will have a capacity of around four million tons/year and has the option to produce either DRI-grade pellets for use in electric arc furnaces or iron ore pellets for use in blast furnaces.

Cleveland Cliffs Steel’s facility in Middletown, Ohio, will receive up to $500 million in government funding to install two new electric arc furnaces using hydrogen-based technology. In another government funded project, SSAB plans to use green hydrogen from its commercial-grade facility in Mississippi to produce direct reduced iron that will be sent to its existing electric arc furnace in Montpelier, Iowa, to produce green steel.

Nucor is building a 3 million ton/year electric arc furnace and sheet steel mill in Mason County, West Virginia which is due to start production in 2026.

What Next?

In the aftermath of the assassination attempt on Donald Trump, forecasting US political developments is not easy. However, there is a clear US protectionist drive in place that extends across the political divide. Protectionism may be more palatable if it is linked to supporting new investment in green steel as is happening in the EU. If it is just slapping on new import tariffs to protect domestic steel producers it could prove counter-productive, boosting inflation and inviting retaliatory responses.