It feels like we’ve been here before in 2018. When, after the shock and awe announcement of 25% tariffs, the whole package was watered down.

For the steel imports, Mexico and Canada got exemptions following a trade deal. The same also happened with aluminium imports. The EU, UK and Japan negotiated a system of tariff free quotas. Other significant countries like South Korea, Argentina, Australia and Brazil were granted permanent exemptions. In addition, US importers could apply for product specific exemptions.

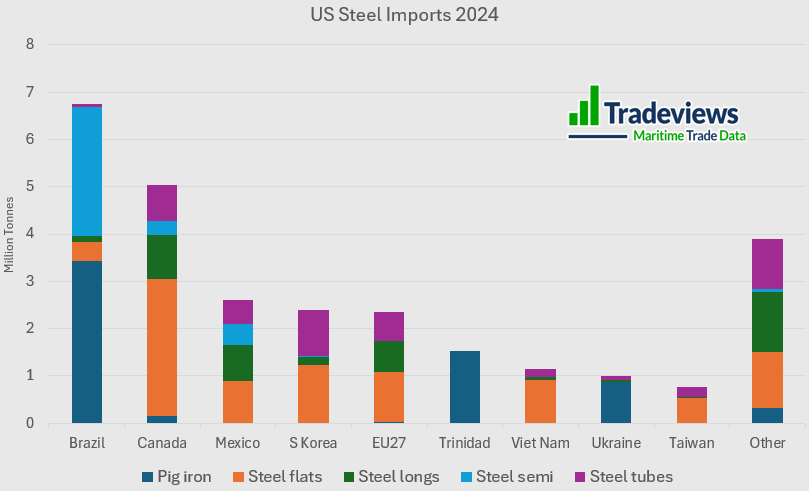

Countries that didn’t get tariff free exemptions currently have very limited steel export trade to the US. For example, China only exported 370k tonnes in 2024 which is just 1.3% of total US imports and thus will be unaffected by any new tariff position. To reinforce the point, China exported to the US in 2024 just 0.5% of their total steel exports.

The bulk of US steel imports today are from countries that negotiated exemptions and or quotas in Trump’s first administration. At face value it looks like Trump is starting this process over again. However, the practical realities that produced these exceptions in the first place still apply. While US primary steel producers will potentially gain from new quotas driving up domestic steel prices, downstream steel manufacturers will be hit by a surge in steel raw material costs. The risk for the administration is in embedding higher inflation and job losses in manufacturing. Looks like we are in for déjà vu all over again!