Recap from last time

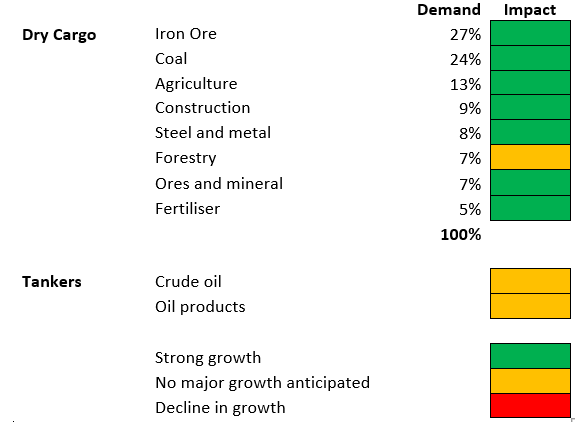

No one can deny that the maritime industry faced many challenges during 2020. Coronavirus was, and remains the challenge of the current era. However, what does the big picture show? It shows not only losers, but winners as well. Some surprised while others flopped. Overturning, as we could also say, the forecasts. The lessons to understand the impact on demand are there, if you look in the right places. So, how to forecast trade in a pandemic?

What do the shipping prophets forecast for 2021? The outcomes of the past are a precious tool to explore the future. Now that we are going through the first months of 2021, early form is giving us a strong indication what this year may hold.

Our Assessment for 2021

Oil

Saying the oil market was turbulent during the previous year, would be an understatement. We have been facing the pandemic for more than a year now and important trends have already begun to emerge. Oil demand has experienced positive momentum due to the gradual withdrawal of lockdown constraints. This should improve even further during the upcoming months as we approach the northern hemisphere summer.

OPEC, Russia and US largely determine market supply. These are the major producers and traders of oil globally. At this time Saudi Arabia has kept its 1m bpd voluntary cut until April. The current supply of oil is less than current demand, which has increased oil prices.

As OPEC+ is constraining supply, while demand is growing, the tanker market is feeling the pressure. In turn this is discouraging news for an already suffering tanker market although there is optimism things will improve in the coming months as lockdowns ease and travel increases.

Iron ore and steel

China pushes on with infrastructure projects and the robust recovery in the manufacturing sectors. Consequently, a high need for steel and its production will continue during 2021, growing the iron ore trade. Steel analysts Fitch solutions predict a 7.5% steel production growth in China and 6.2% India. Globally they expect 4.9% growth. As steel directly and indirectly accounts for approximately 50% of dry cargo trade, then surely this is the backbone of a robust year for the dry cargo sector.

Coal

During 2020 coal trade faced a huge decrease due to economic contraction triggered by the pandemic. However, we predict a better year. Based on EIA, there will be a 2.6% rise in global coal demand in 2021, driven by higher electricity demand and industrial output. The major growth, in terms of the demand side, will occur in India, China, and Southeast Asian, where economic development programs are a priority on the agenda for this year. It’s also work noting, these countries are the bigger coal importers globally.

Coking coal trade remains uncertain as the outlook for China’s trade policy remains unclear. What is certain is that Chinese bans affect seaborne coal prices and trade flow, amid continuing Chinese coal import ban from Australia.

Agriculture

Agriculture trade significantly increased in 2020. We predict a positive trend this year too. China will be the driver. They are determined to recover from the African Swine Fever, which decimated their pig population. China is under pressure to strengthen food security and pigs are on the rise. Therefore, soya bean and corn are a driver of demand. To add to this, Chinese grain stocks are low. Corn stocks are 10% under and Soya bean is 19% under what it should be this time of year.

Everything seems auspicious so far. However, high demand is not enough. It needs to be covered by the corresponding supply, and here lies the problem in this specific case. First of all, soya bean stocks are low due to a strong 2020. Dry conditions in South America, forced Argentina to move to a two-month maize export ban in January and February, in order to meet its domestic needs. Don’t forget that Argentina is the world’s No. 3 supplier of corn. Russia also imposed a 50 Euro per tonne wheat export tax to end of June, in an effort to stabilize domestic food inflation. Lastly,government forecasting Abares suggest Australian wheat is expected contract to 25 million tonnes 2021-22 from 33.3 million tonnes in the previous season.

Unprecedented demand at a time when supply is not guaranteed has pushed grain commodity prices to levels not seen for over 5 years. Therefore, large gains and losses are now available to traders, making the timing of shipments crucial and contributed to the strong Panamax freight rates at the start of the year. We expect this trend to continue.

Vessel Demand

In the dry sector the last few years have been strong for the larger sizes. Capesize and Panamax vessel demand has been growing at approximately 3% while the Supramax and Handysize are struggling to find any positive growth. This year will be a distinct change. We believe that all the sizes will see positive growth and they should have continued volatility throughout the year. The ups and down will continue to surprise and may well appear counter cyclical. But what’s causing this and how to forecast trade in a pandemic?

Increased volitivity is likely caused by a number of factors. In the early part of the year, it was linked to the rapid change in commodity prices. Timings for vessel schedules was heightened as traders wanted cargoes moved by specific dates. Extreme weather conditions are also played havoc in the first quarter. The cold snap in the northern hemisphere meant that ice class vessels were in particularly strong demand. All these things meant that freight rates were riding high, particularly Panamax vessels, at a time when they should have been in depressed. This volatile trend is expected through out this year as Covid changes normal global behaviour.

Tanker vessels however are over supplied which is suppressing freight rates. Scrapping of older vessels is the only way to correct the problem long-term. Layups, however, don’t seem to be the best solution this year as demand is likely to come back when Covid restrictions lift in the northern hemisphere summer. This could benefit the smaller Aframax vessel in particular, which has been hit the hardest across the vessel types.

Conclusion

A ‘rebound’ is projected this year for dry cargo trade. The demand side of the equation looks strong but it may be held back by constrained supply. In particular iron ore and agricultural products output will not be able to keep up demand. OPEC surprised the oil market recently by not increasing supply as demand is clearly growing, so it will be interesting to see how this year pans out. Overall, we remain cautious with the tanker outlook.

COVID-19 will still directly affect demand. Major uncertainty still remains as restrictions affect economic activity in key regions. The new varient coronavirus strains meant that lockdowns at the start of 2021 were harder than we first anticipated. Therefore the twists and turns of the pandemic are far from certain.

However, many factors are at play that will increase volatility and we foresee this continuing during 2021. For maritime investors this will provide earning opportunity and will ensure a dynamic market. Those that have learned the lessons from the past surely know how to forecast trade in a pandemic and to profit in 2021.