Everybody is watching Trump’s every words since he was elected president. While he’s threatened to disrupt world trade with tariffs, we only change our forecasts when these threats become actions. His protectionist stance however is bound to have considerable influence.

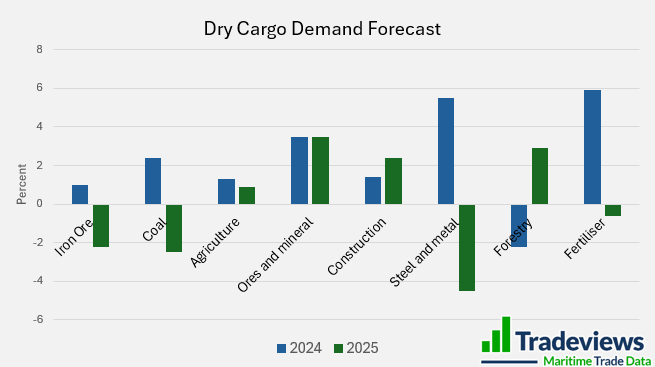

It’s a good time to review what we do know about the 2025 shipping market and provide a quick overview of Tradeviews’ perspective. We expect overall dry cargo growth to decline by about 1% in 2025. This is because while some commodity groups are growing, others are shrinking. Unfortunately, we predict that demand for the two largest commodities, iron ore and coal, will decrease.

Starting with iron ore, we believe that China’s continued economic difficulties will limit any significant steel growth in 2025. Additionally, the stockpiling of iron ore in 2024 means that matching that level of imports will be challenging. Therefore, our forecast shows a 2% decline in iron ore demand.

Regarding coal, it appears that 2024 was the peak coal consumption year and we anticipate that coal trade will fall by approximately 2.5% in 2025. This is a difficult commodity to predict because weather and consumption habits tend to be volatile. However, China continues to invest heavily in renewable energy, suggesting that the years of strong coal demand increases may be ending. Also, Japan has increased its nuclear output, so we believe their coal demand will decline slightly. Coupled with Europe’s commitment to decarbonization, we foresee a further decline in coal imports to that region.

However, areas of growth are generally found in the “minor bulks.” We anticipate continued growth in agriculture, around 1% for 2025, based on our interpretation of the latest USDA forecasts. Ores and minerals continue to show a strong growth path, and we believe cement and forestry will also be stronger in 2025.

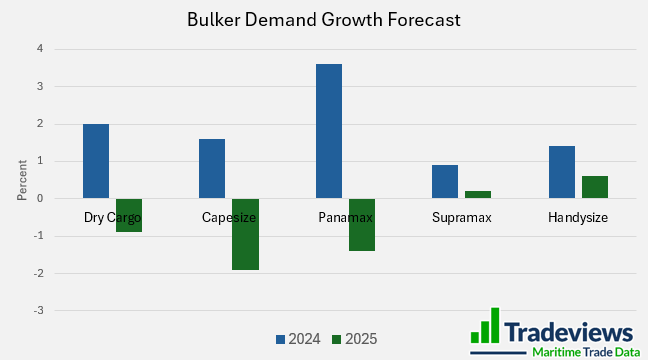

Taking all of this into account, we predict that the Handysize segment will experience the strongest vessel demand growth this year at 0.5%, followed by slight growth in the Supermax segment of 0.2%. Unfortunately, we foresee a decline in demand for the larger vessel sizes, with the Panamax and Capesize segments experiencing declines of 1.4% and 1.9%, respectively.

Therefore, 2025 appears to be a challenging year in terms of demand growth. However, many factors can influence the overall picture throughout the year, including operational factors and fleet changes. Tradeviews provides a month-by-month interpretation of demand, supply, and utilization, which can be valuable for fleet strategy planning, including hedging and FFA positions. Please get in touch if you’d like to explore the benefits of our detailed forecasting for managing your fleet positions.