The Multipurpose Vessel (MPV) fleet is often little understood and a confusing sector. Luckily we have Susan Oatway from Drewry who is an expert. She has just published their quarterly update. Susan has a distinguished maritime career and is currently Chair of the Institute of Chartered Shipbrokers. I dropped into her recent MPV webinar and picked up some of her wisdom:

Freight Rates

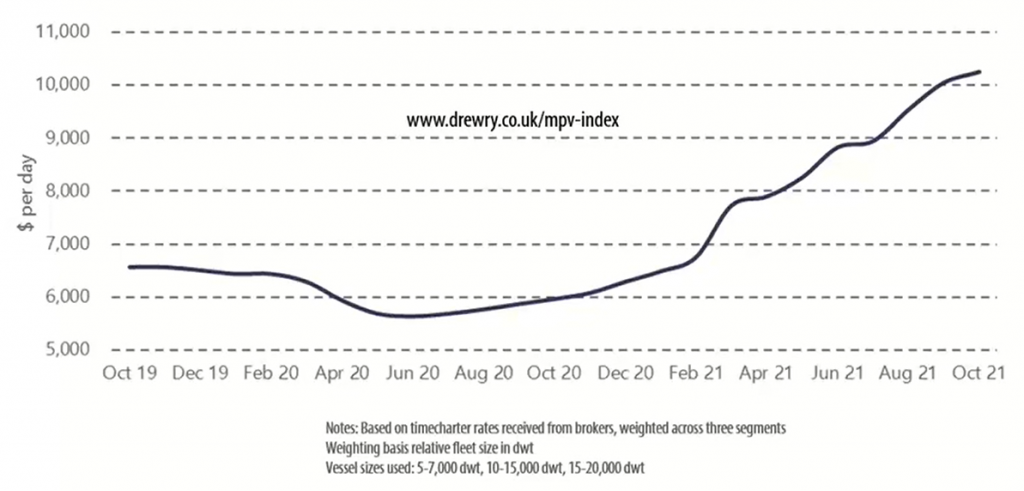

Since April period charter rates have risen by over 40% for the larger vessels and 10% for the smaller. This produced a rise in our weighted index of almost 30%. Rates are now over 70% higher than they were this time last year. This index is based on average annual one year period charter hire rates for three main sectors across the fleet. We weight these to work out an average of the fleet, and then we plot them.

So over September the index rose by just over 5% compared to August. And we’re predicting a further rise of about 2% in October that’s largely due to the ongoing capacity constraints. With the competing sectors, it keeps break-bulk and project cargo demand high for these heavy lift capable tonnage.

Demand

2021 has been marginally better than we all expected just twelve months ago. GDP growth for the year is estimated at 5.8% compared to 2020, as opposed to the 5.4% that we were predicting twelve months ago. There’s a general expectation that the global economy will return to pre pandemic levels of growth by 2023. That’s at around 3% annual growth per year.

To determine the future outlook for the MPV market, we need to start with the underlying demand for MPV Tonnage. Although there are many factors that make up that demand, the strength of the global economy is a good place to start. With the obvious exception of 2020, dry cargo volumes have risen an average annual rate of around 3%, since 2012 to 2021. Total dry cargo volumes are made up of bulk cargo, containerised cargo and general cargo, which is largely break bulk and project cargo. Containerised cargo has grown at an average annual rate is 3.7% compared to bulk cargo at 2.8%. Our expectation is the 7% growth seen over 2021 will inevitably slow over 2022 to a more reasonable 4.5%.

To determine the multipurpose share of total dry cargo we assess the total bulk and general cargo and we make an assessment of that market share. Much of the recovery at the beginning of 2021 was goods led. Consumer spending had not switched back to services from physical goods after the lockdown periods. Indeed, that’s really been the case for most of 2021, and it’s part of the reason behind the supply constraints we’ve seen over the last few months. The other phenomenon in 2021 has been the return of break-bulk commodities to more traditional modes of transport, away from containers. It’s this that has boosted the growth in the MPV share to some 10% compared to 2020. Again, we expect that growth to slow. But we expect market share to rise further 2% over 2022 as these continued problems in the supply chain keep break-bulk cargoes on multipurpose ships.

The next step in our process is to work out the effective demand for the multi-purpose fleet. How much of the cargo volumes could be carried by bulk carrier, container vessels, ro-ro’s or other vessels. Then when we take those out, we’re left with the demand for multi-purpose and heavy lift vessels. In our forecaster report that we’ve just published, we look at a range of scenarios for the market to give an upside and a downside potential for all our forecasts to 2025.

Fleet Supply

New build activity remains subdued and the orderbook low. At the beginning of September, the order book stood at just over 1.1 million deadweight. That was equivalent to less than 4% of the operating fleet. Over the last quarter it’s slipped to under 50% heavy lift capable tonnage and 46% under 10 thousand deadweight. So for the previous five years, most of the growth in this fleet has been from the project carrier sector.

But it appears that the global pandemic has caused ship owners to reassess their needs. This sector is one of the most cautious when it comes to long term investment. And as I’ve said in Drewry’s briefing paper that was published on Monday, it’s a very niche sector. It’s heavily influenced by the competing container and bulk sectors, and it’s also a sector for which there’s only little speculative market.

Owners build to replace or they do so with a particular commodity project contract in mind. The MPV market has also been in recession for the last ten years and rates have been at or in some cases below operating costs. There’s very little spare cash, and that’s even after a Bull market that’s run for the last nine to twelve months. If you add into this the simple fact that the yards are full of orders for he container ship or bulk carriers. Even if MPV had the spare cash and the desire to build, there are very few slots available.

There’s been over 3 million TEU of container carrier tonnage ordered so far this year and 27 million deadweight of bulk carrier tonnage compared to less than half a million dead weight of multi-purpose tonnage. Those vessels of the competing sectors will be launched from 2023 onwards at a point where the market should be returned into pre pandemic demand levels. Drewry therefore thinks that there may even be some advantage to having a slightly tighter supply position for the MPV fleet, especially if demolition numbers have picked up by then.

In 2021, new building deliveries have outmatched demolitions and we expect to see a rise in the total fleet of about half percent per year for both 2021 and 2022.

Risks To outlook

On the upside, it’s still about getting the vaccine out on a global basis coupled with continued supply chain issues from the competing fleet. Because that sort of almost negative situation is a positive demand factor for the MPV fleet. On the downside, the risks are further restrictions due to the virus weakening confidence, reduced economic investment for new projects and longer term the potential for over supplying the competing reducing demand for multipurpose tonnage.

In the short term, we expect rates to continue to rise over fourth quarter 2021. But still very much in that boom situation. There is very little, if any, spot market activity going on at the moment. Most owners are booked towards the end of the year, so those rates will continue to be very high, but we expect to slow over 2022. The supply and chain problems will start to come under control and shippers are reaching a ceiling with regards to the phrase that they are able to pay.

I’d like to thank Susan and Drewry for their webinar and insight. If you’d like to purchase Drewry’s full report, you can purchase a copy here.