The Shipping sector is going through a significantly volatile period. The pandemic has changed the rules of the game, which seems more unpredictable than ever. The consequences of the pandemic have spread into almost every aspect of this global sector. However, shipping can seem like a seesaw and when the balance is lost, one side is up and the other is down.

This fact can be easily illustrated in the case of some cargo types. Some bulks can be shipped either in containers or in dry bulk carriers. Of course, each one of these two types of vessels, serves more effectively with specific cargoes, depending on supply and demand and trading patterns. Nonetheless, price, and more specifically freight rate, has the power to define traders’ final decision, regarding the mode of transport.

What happened in 2020?

Container freight rates have been on a roller coaster ride. This fact can be attributed to a number of causes. First of all, at the time countries started to impose economic and social restrictions due to the pandemic. This situation made vessel supply more precarious. After a period of time, there occurred improvements in some economies and the demand for cargoes and shipping services improved again, while a shortage of empty containers remained. The increase in demand and decrease in container supply (containers were out of position or trapped on vessels waiting to dock) resulted in an excessive rise of freight rate for containers.

Freight Exposure Example

As freight rates in containers surged, charterers who used containers could switch back to dry bulk carriers.

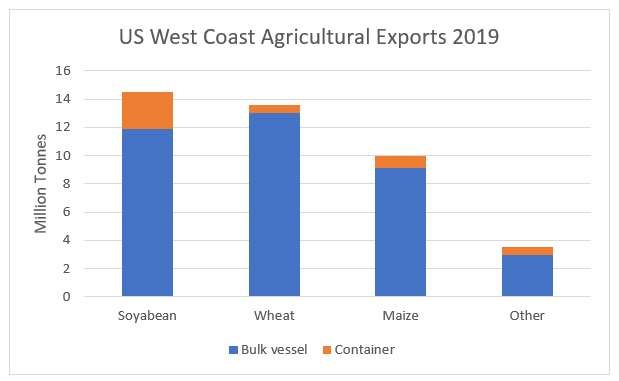

Let’s look at an example of agricultural products exported out of the USA West Coast. In 2019, 41.6 million seaborne tonnes were exported according to Tradeviews data.

Approximately 11% of these traditional bulks were transported in containers. That’s 4.5 million tonnes which equates to an extra 90 bulk vessel sailings a year if they switch to bulkers. Our data shows the vessels used were Panamax, Supramax and Handyside, roughly split one third each. While we wouldn’t expect all these container trades to move to bulk vessels, there is potential for a shift in momentum.

At the end of the day, the trader has to evaluate all the relative aspects, so as to find the most profitable way to ship its cargo. The aspects include freight rate, quantity, nature of the cargo, the distance and operational considerations. While container lines are raking in the profits of the supply/demand mismatch, bulker operators could also get extra lift. Cargoes moving to containers could supporting an already impressive freight rate for a traditionally slow first quarter.